Is it actually ever smart to borrow money aside of your own advancing years account to cover an enormous pick? Financial off Father has many viewpoint.

Hi Bank off Father. I’m undergoing purchasing a property and just have become informed one, in this case, its ok to help you withdraw off my 401k, hence, right now, have regarding the 100K in there. I’d need to take an effective $40K financing out over improve down payment. There are numerous articles about the risks of borrowing from the bank regarding 401k as well as those that explore situations where its okay to do this. Exactly what do do you consider? Am I stupid to get so it loan? I am aware referring so you’re able to looking at the attention I create gain on the financing were We having left it unaltered in the membership additionally the value accrued https://elitecashadvance.com/personal-loans-mo/augusta/ inside the my domestic. However they are indeed there people charges when deciding to take currency away? Also: How can i make the money aside and are also there actually ever any situations where borrowing from the bank regarding one account is the best move? I intend to put the cash back in the account. – George, via email address.

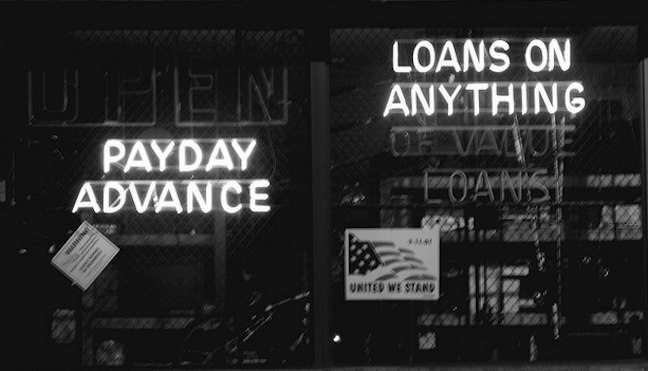

At first sight, credit from your own later years account seems like a pretty great contract. Zero credit score assessment? Lower origination charge? Attention you spend to on your own rather than a lender? What is never to such as for example?

However, such as for instance sleek gems marketed from the trunk out-of an enthusiastic ’92 Lincoln, 401(k) financing appear much less appealing the newest nearer you appear. For the it, they generate the quintessential sense as the a history-lodge source of funds not a thing we wish to lean into the when designing a giant get. Why? Just like the move currency from your nest-egg is among the most new surest an easy way to derail your a lot of time-name savings and you may possibly have a large tax bill.

It is a fact that when your employer is one of the over 80 % out of companies which offer finance, you need to be able to availableness at the very least a number of you to definitely currency. Irs legislation allow you to remove 50 percent of your vested account balance, doing $50,100, to possess finance. The key this is actually the vested region. For you personally, the sum of the contributions and you may rollover amounts, together with one vested complimentary finance, needed to be at the very least $80,one hundred thousand to carry out a good $40,100000 loan.

Your normally have to blow straight back the principal and you can appeal over a great five-season period. A separate ability regarding 401(k) financing is that the focus you pay in certain cases the top price and something commission section gets added to your account balance.

But, my personal oh my, will they be laden with homes mines. I prefer to consider old age discounts since sacrosanct, states Rebecca Kennedy, an economic coordinator that have Denver-built IMPACTfolio. In all honesty, the idea of taking out an effective $forty,100000 mortgage out of a beneficial $100,100 account balance issues me. Here’s how an effective 401(k) loan you to size can backfire:

- You will experience a large Cash Crunch

Which have home financing, you have the option to spread out money over a 30-12 months several months. You are and come up with much larger repayments, and that mode less of your budget to spend the mortgage, added to an emergency funds and you can, you are aware, consume. The plan you will accommodate expanded payment because it’s becoming useful a property pick, claims Kennedy. Nonetheless it you may nonetheless translate to a substantial monthly otherwise quarterly percentage that needs to be factored to the cash flow.

- It’s a big Pull on your own Old age Coupons.

However,, tend to, you have to pay straight back a great 401(k) financing in only 5 years

While repaying the borrowed funds, you will have less money to invest when you’re because expidited payment agenda. Which is a big possibility wasted. Among the many pure secrets to smart old age believe is beginning very early. Most of the dollars you spend when you are more youthful has the opportunity to earn compounded gains if it stays in your account. And so the $100 your put money into their twenties ends up getting a lot more valuable compared to the $a hundred your throw-in just before advancing years. We need to continue that cash throughout the account, in which it will develop.Including, you might be paying down oneself having blog post-tax moneypare you to definitely on income tax-deductible 401(k) benefits you might be and then make for those who didn’t have the mortgage. You might be forgoing a huge work with on the income tax code.

- You may get Stuck with a big Tax bill.

One amount borrowed that you do not pay-off timely gets treated since an early on delivery whenever you are not as much as 59?. That means you’ll have to not need to shell out taxes on that matter, however, happen an excellent 10-% penalty out-of Uncle sam. Yikes. Maybe you have over the latest math and do not think dropping about on the your loan is a significant care and attention. Keep in mind, even in the event, that should you leave your work unconditionally, you will probably need to pay back the complete matter by April fifteen of your following seasons to get rid of a taxation punishment. Predicated on an effective 2015 working papers to the National Agency out of Financial Lookup, as many as 86 per cent of people that leave work during payment standard on their mortgage. Eighty-half dozen percent! If you have already used the newest 401(k) borrowing from the bank Kool-Help, you to definitely figure alone is to jolt your with the sobriety.

I could yes see why individuals rating jittery concerning the inventory market, provided their inescapable good and the bad. But not, it’s made much higher output along the continuous than actual property.

To purchase property is not constantly a successful campaign, given that members of specific construction economic crisis, says Kennedy. Hindsight will state if our company is close to the height or perhaps not, but all family sales now might be made with brand new purpose out of being lay for a while.

You are not losing some of that money to a bank otherwise other financial

Without having the way to pick a home in the place of tapping into your own 401(k), that might be a code your getting back in over their lead. And if you’re primarily looking at the home as a financial investment, you are probably better off using pre-income tax currency so you can vast majority enhance later years membership. If you dedicate using an age-compatible asset combine, you are possibility of increases would be much greater.